The Strategy seeks total return. This is accomplished, primarily, by investing in publicly-traded equity and debt securities of U.S. energy companies involved in the extraction, processing, distribution or use of natural gas, oil and coal. The Strategy may invest in companies of any size and in initial public offerings.

The Midland Basin, a subset of the prolific Permian Basin, is known for its high oil-in-place content, stacked pay zones and substantial existing infrastructure with premier midstream and marketing solutions allowing for operational efficiencies. BPC Energy has over 100,000 net acres of this best-in-class reservoir rock located primarily in Howard County, Texas. With the blocky nature the acreage position and shallower pay zones, BPC Energy has become one of the most efficient and cost-effective Operators in the Midland Basin.

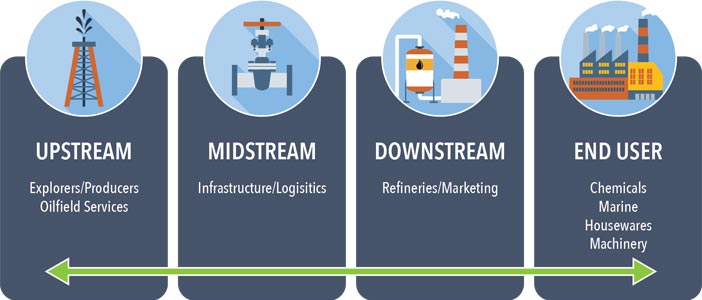

The BP Capital strategies invest in companies across the full spectrum of the energy supply-demand value chain which the Advisor believes are well-positioned to take advantage of the opportunities related to the American Energy and Industrial Renaissance

Our energy investments gain a unique perspective (informational alpha) in the energy investment landscape from our affiliation with BP Capital, which manages commodity/energy equity hedge funds and holds private assets and mineral interests..

The BP Strategies leverage insights gained through energy sector knowledge, MLP investment experience, deep relationships and trust earned over the past 60 years to create value for Clients.